Amazon Lending Program

What is the Amazon Lending Program?

Amazon Lending is a short-term financing service that helps eligible sellers expand their businesses. Amazon assesses sellers based on their potential to boost sales and maintain high customer satisfaction. Qualified sellers can receive business loans for 3, 6, 9, or 12 months. The program aims to support Amazon sellers by offering the capital needed to buy inventory, broaden their product offerings, and manage other business-related costs.

Amazon Lending Program Pros and Cons

Pros

- Quick Access to Funds: Sellers can obtain capital swiftly to invest in inventory or expand their business operations.

- Convenient Application Process: The application is simple and completed through your Seller Central account.

- Automatic Repayment: Loan repayments are deducted automatically from your sales, easing cash flow management.

- No Collateral Required: Generally, Amazon does not require collateral, making it easier to secure a loan.

- Support for Growth: Helps sellers scale their business by providing the necessary financial resources.

Cons

- Invitation-Only: The program is available only to sellers who receive an invitation, limiting access.

- Eligibility Criteria: To qualify, you must have a strong sales track record and a high level of customer satisfaction.

- Limited Transparency: Interest rates and detailed loan terms should be disclosed upfront, making it harder to evaluate the cost of borrowing.

- Potential for High Costs: Without clear information on interest rates, the loan’s actual cost might be higher than anticipated.

- Dependence on Sales Performance: Repayments are tied to sales performance, which could be challenging if sales fluctuate.

How to Get Funding from the Amazon Lending Program?

Eligibility Criteria

- Sales Growth: You must have a proven track record of increasing sales.

- Account Standing: Your seller account should be in good standing with high customer satisfaction levels. Poor customer service metrics or policy violations will likely disqualify you from receiving an invitation.

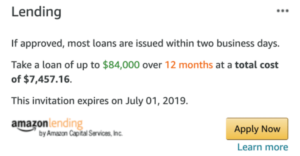

Loan Terms

- Loan Amounts: Ranges from $1,000 to $750,000.

- Term Lengths: Available in 3-, 6-, 9-, or 12-month terms with fixed monthly payments.

- Interest Rates: Not disclosed by Amazon.

Each seller receives different terms based on their individual circumstances, and detailed loan information is only provided upon eligibility.

How to Apply for Amazon Lending?

Amazon Lending operates on an invitation-only basis. If you qualify for a loan, an Amazon Lending widget will appear on your Seller Central account homepage, allowing you to apply.

To apply for Amazon Lending, you must first receive an invitation from Amazon. You will find the invitation in your Amazon Seller Central account if you are selected as a potential candidate. Applications can only be made with this invitation.

How quickly can I get the funds after applying?

After applying for Amazon Lending, the review process typically takes a few days, and funds are usually disbursed within 1-2 business days of approval. The exact timeline can vary based on the completeness of your application, the status of your Amazon seller account, and how quickly you provide any additional required documentation. For the most accurate details, it’s best to check directly with Amazon Lending.

What happens if I miss a loan payment?

Missing a loan payment for Amazon Lending can result in late fees, negatively impact your Amazon seller account status, and potentially lead to more severe collection actions. Although Amazon Lending does not directly report to credit bureaus, missed payments could affect your future borrowing terms with Amazon and other lenders. To mitigate these issues, it’s important to communicate promptly with Amazon Lending if you anticipate payment difficulties.

Can I use the loan for any business expense?

Yes, Amazon Lending loans can generally be used for a wide range of business expenses. This includes inventory purchases, marketing, operational costs, and other expenses that can help grow your business. However, it’s important to review the specific terms and conditions of the loan to ensure compliance with any restrictions or guidelines set by Amazon. For precise details on allowable uses, consulting the loan agreement or contacting Amazon Lending directly would be advisable.

Book your Free Consultation with us, or get in touch here: james@realdigital.tw