Amazon Keyword Tips: 6 Mistakes New FBA Sellers Make

Amazon keyword research is the bread and butter of any successful product-selling campaign.

An Amazon report reveals that 7 out of 10 Amazon shoppers do not venture beyond the first page when seeking to make a purchase. Furthermore, more than simply appearing on the first page might be necessary, as 35% of Amazon buyers tend to click on the first search result.

Without keyword research, how would one know the interests of potential customers and position themselves in front of these consumers?

Neglecting or inadequately performing keyword research can negatively impact Amazon ads. Considering that every click incurs a cost—even if it originates from someone outside your target audience—ineffective keyword research proves costly.

Moreover, mistakenly bidding on inappropriate keywords could result in competitors seizing market share while you remain unaware, making effective keyword research crucial.

From any perspective, neglecting proper Amazon keyword research bears no advantage. Conversely, when conducted meticulously, it can yield multiple returns, promising one of the most favorable returns on investment (ROI).

Most of these mistakes are rookie-level errors you want to avoid when selling on Amazon. Likewise, it’s a good refresher for intermediate and expert sellers. Hence, they avoid falling prey to simple issues while scaling their Amazon FBA brands.

Mistake 1: Not using keyword research tools

Keyword research tools still require you to enter a seed keyword, only scraping data from Amazon search engines, which you can do manually. It usually costs you a monthly or annual fee or credit prices, but savvy users can find ways to mitigate these costs.

These keyword research tools will:

- Suggest keywords you didn’t even know buyers in your niche were looking for.

- Discover new keywords buyers search for your product with so you can be the first mover.

- Allow you to organize hundreds and thousands of keywords at once.

- Expose negative keywords that undermine your Amazon PPC campaign, unnecessarily increase your Advertising Cost of Sales (ACoS), and eat into your ROI.

- Allow you to filter an extensive keyword list to quickly see a streamlined version of what works with your Amazon marketing and targeting strategy.

- Ultimately boost your sales by ensuring you get more impressions, clicks, and conversions without competing for the keywords everyone else is targeting.

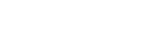

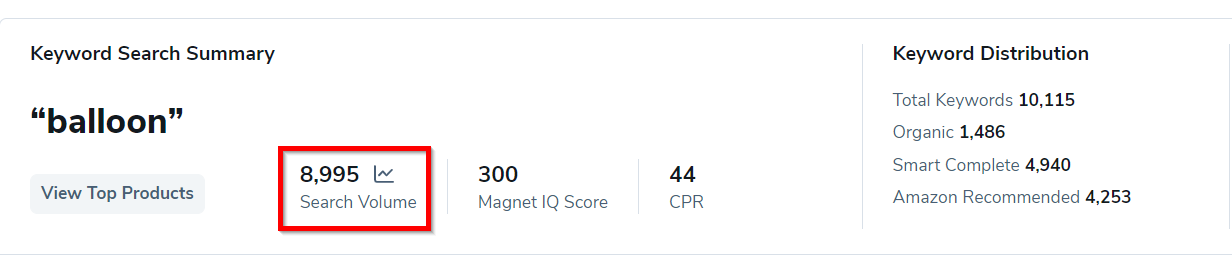

For instance, thousands of Amazon listings offer balloons to customers, competing for a share of this 8000+ monthly search volume.

So, instead of optimizing for “balloon” alone, I can spice up my listings with “table decorations for birthday party,” which will put my listing in front of more potential buyers.

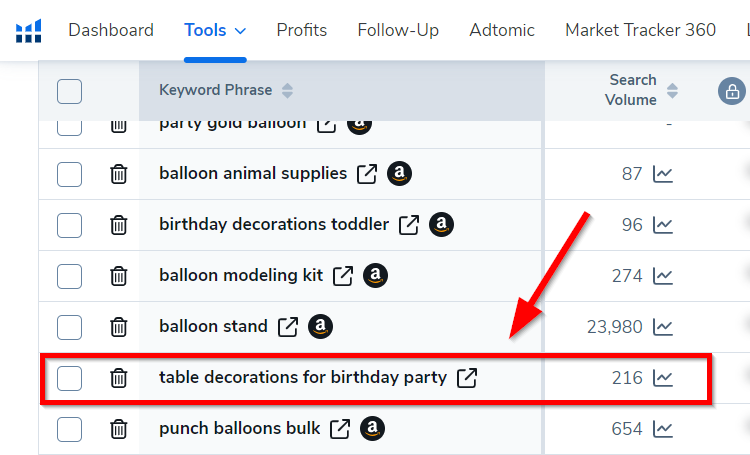

Mistake 2: Choosing the wrong marketplace

Always keep your attention directed toward the specific marketplace during Amazon keyword research.

Even though Amazon operates across markets like the US, UK, Canada, Australia, Poland, and others, the keyword data must be universally consistent across all these platforms. Therefore, a keyword deemed competitive on Amazon UK might have a different competitiveness on Amazon US.

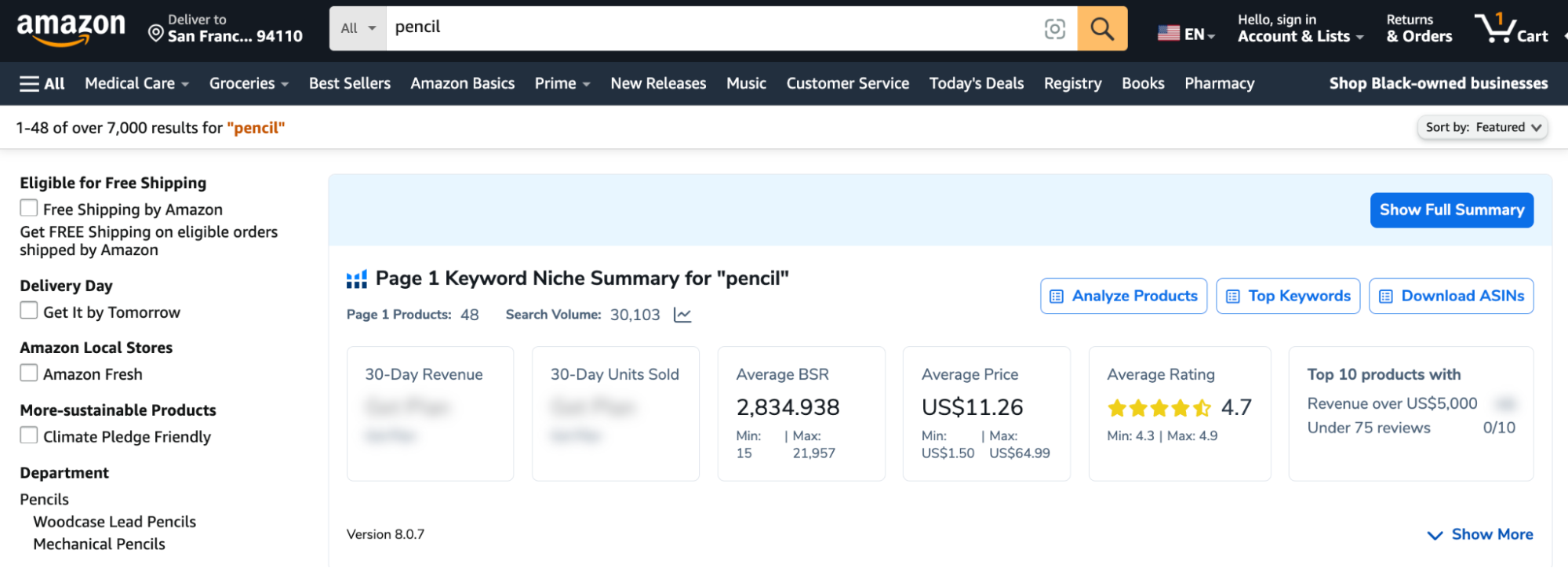

For example, the keyword “pencil” only has a CPR of 45 on Amazon Canada, with just under 10,000 monthly search volume.

Moving over to Amazon USA, the same keyword has over 7,000 monthly searches with a lower CPR.

You can get product/keyword ideas from other marketplaces. However, always validate against your marketplace before using such keywords.

Mistake 3: Not doing manual research

Keyword research tools serve as aids, providing guidance and simplification to the process, yet they cannot entirely substitute the human input.

Inexperienced individuals tend to rely solely on the data provided by keyword research tools, particularly when assessing keyword difficulty. This poses a risk, especially when determining the complexity of a keyword.

These tools utilize data metrics to approximate volume, trends, and difficulty, which leads to variations in opinions among different tools for the same keyword.

However, does this imply the complete avoidance of keyword tools? Not at all. Neglecting them may result in missing out on unique keywords and variations.

To effectively leverage these tools, input your initial keywords or phrases into your preferred tool, filter and gather keywords within your specified criteria, and conduct manual investigations.

This approach allows the keyword tool to streamline many keywords, saving time and resources on manual research. Thus, you can dedicate efforts to thoroughly examining the remaining keywords.

Define metrics like active listings, exact match keyword bids, etc. to determine keyword viability during manual research.

Mistake 4: Going for shorter tail keywords

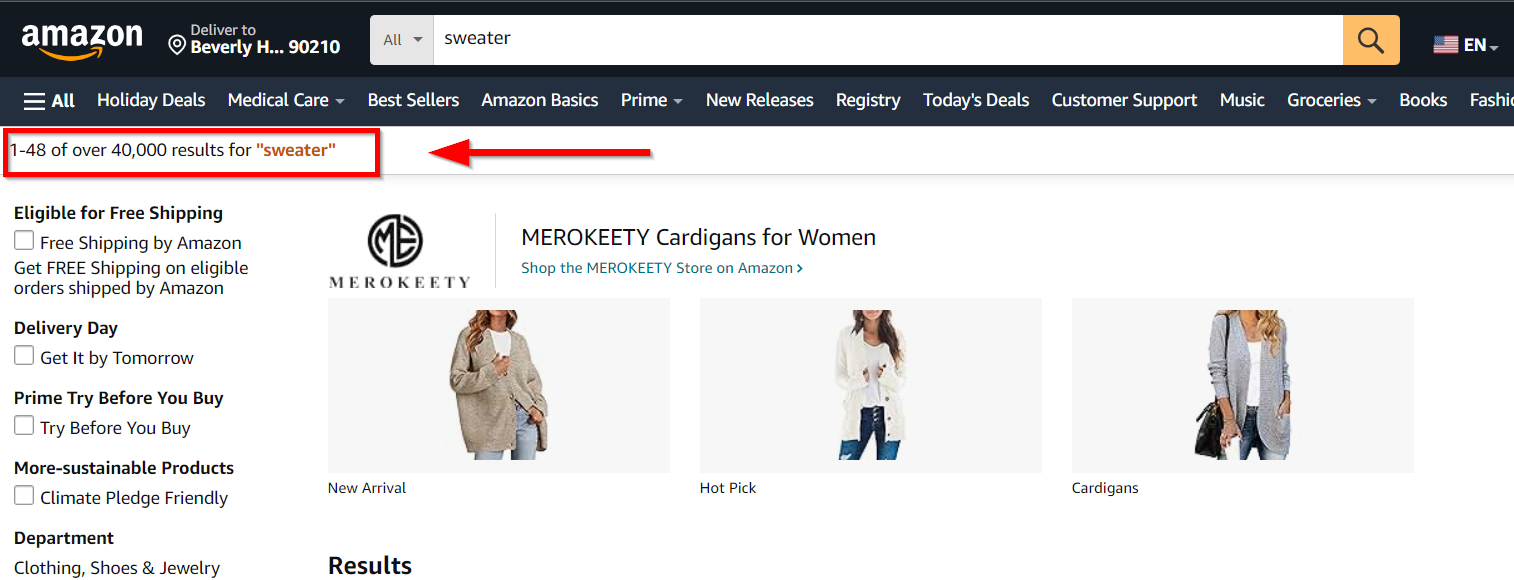

Wouldn’t it be beneficial to optimize your product listing using a keyword such as “sweater” and attract traffic from individuals seeking fashion statements and those needing apparel out of necessity?

You’ll compete with about 40,000 other products on Amazon US to gain the top spot for that keyword.

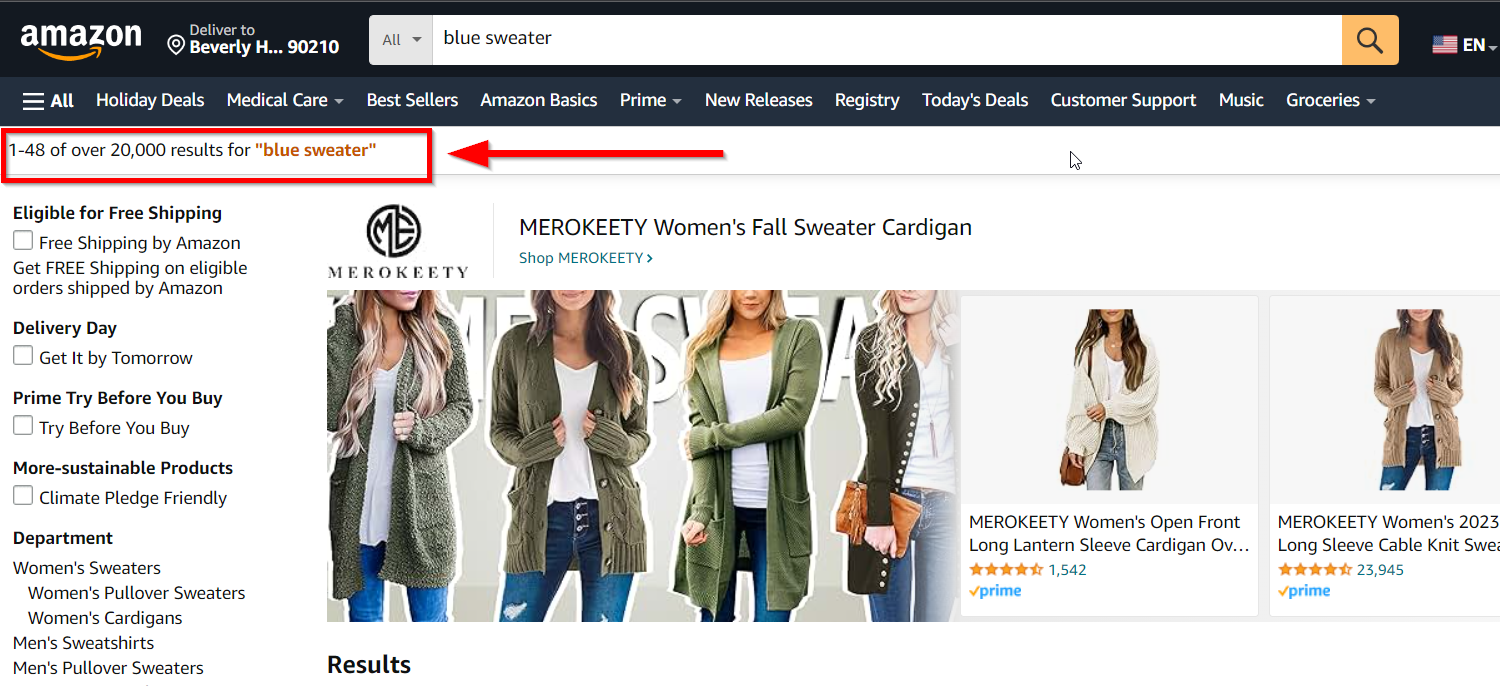

Let’s refine our search to something like “blue sweater,” we’re down to competing against 20,000 products. It’s still a large number, but adding just ONE word cut the competition pool by half!

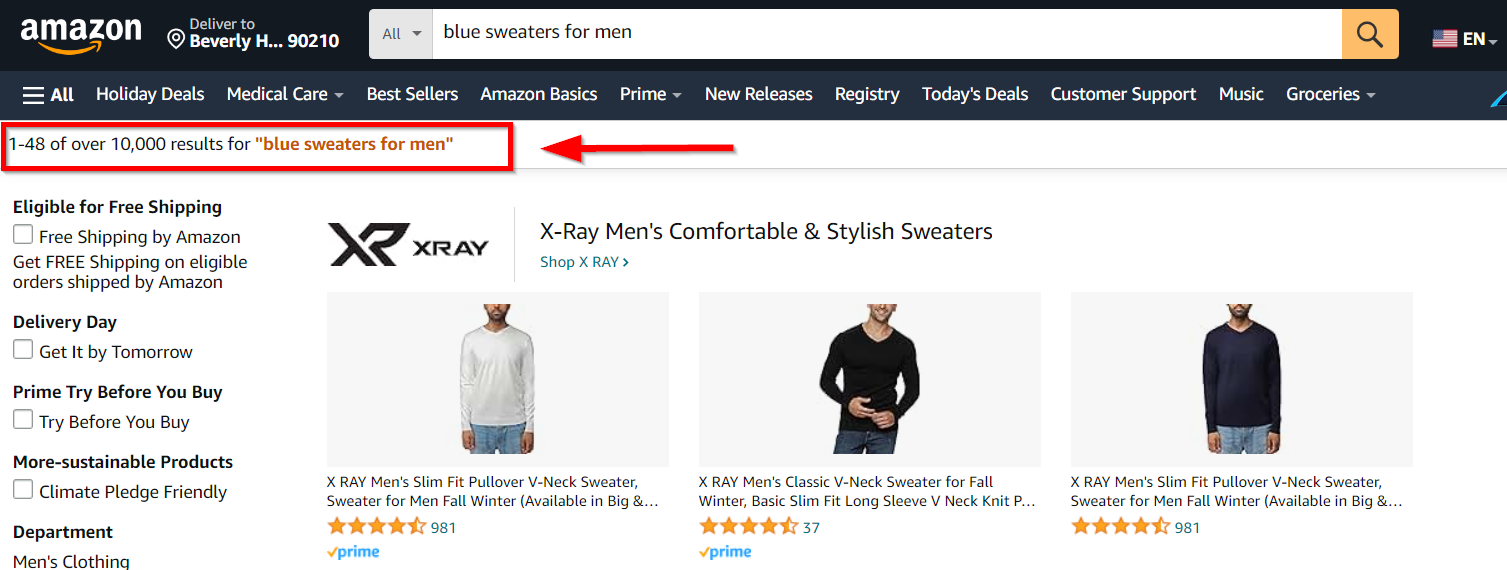

If we dig further and try to optimize for “blue sweaters for men,” we get to cut the competitor pool by half again.

Now that we’ve clarified that optimizing and achieving higher rankings for longer tail keywords is more straightforward, it’s important not to insert unrelated words into your Amazon listing content randomly! Verifying that the keyword holds active search demand from your intended audience.

This is where product research tools prove beneficial once more. Otherwise, you might end up with a low-competition keyword that needs more demand, resulting in minimal activity for extended periods.

Use a keyword research tool to filter by word count. Enter your seed phrase/keyword and set the minimum results filter to 4-6 words. You’ll usually find related keywords with decent search volume and low competition to optimize.

Mistake 5: Ignoring Negative Keywords

It’s common for newcomers to focus heavily on researching profitable Amazon PPC campaign keywords, often overlooking the importance of researching negative keywords. Neglecting to include negative keywords means your ads could be displayed to everyone searching for a broad match term, even if it’s unrelated to what you’re selling.

For example, if you sell office chairs and you’re bidding on the keyword “chairs,” Amazon won’t know that you’re not selling patio chairs, party chairs, and other types of chairs. So, when someone searches for other keywords, your ad pops up, and they might click it.

It’s essential to frequently review your Amazon search term report to pinpoint negative keywords. However, this approach comes after the fact, and you may have been losing considerable ROI, consequently increasing your ACoS.

Therefore, when Amazon shoppers search for related keywords, it’s crucial to compile a robust list of negative keywords you don’t want your products associated with.

Mistake 6: Adapting Irrelevant Keywords

We previously mentioned delving into your initial seed keyword or phrase to uncover variations. Similarly, I highlighted the benefit of using long-tail keyword variations to expand your product’s visibility with terms others might overlook.

Nevertheless, it’s crucial to understand the distinction between this strategy and excessively cramming your content with irrelevant keywords.

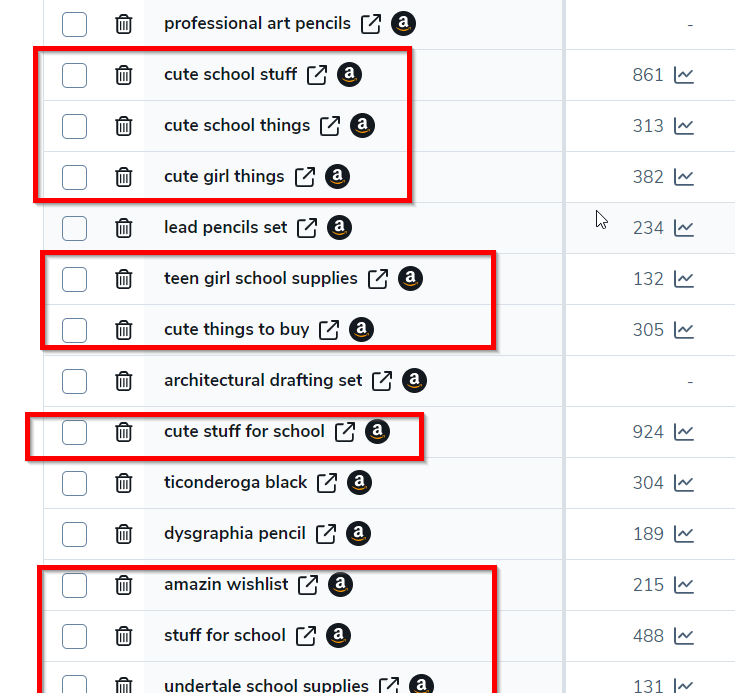

The fact that a string of keywords shows up during your seed keyword research doesn’t mean it should go into that campaign. For example, a search for “pencil” yielded some results identified below, which aren’t necessarily relevant to what we want to achieve:

- Teen girl school supplies

- Amazin wishlist

- Undertale school supplies

- Things cute, etc.

Implementing these keywords to undercut the competition could blow back because:

- People searching for such keywords may be looking for something other than pencils. So, you’ll get more impressions, very few clicks, and even fewer conversions, if any.

- You’ll waste money that could have been well spent elsewhere on your Amazon PPC campaign if shoppers keep clicking on your listing for the wrong reasons.

- You’ll waste time that could have been spent optimizing and ranking for better keywords.

One of the best ways to find relevant keywords is to dig deeper into keyword variant research rather than stick with the seed keyword research only.

Conclusion

Several factors may be at play if you need to receive reviews on Amazon. Optimize your product listing with high-quality images and clear descriptions to enhance customer confidence. Actively engage with customers through post-purchase emails, requesting reviews without violating Amazon’s policies.

Ensure your product is competitively priced, and use advertising to boost visibility. Address any shipping or fulfillment issues promptly to prevent negative experiences. Offer exceptional customer service and differentiate your product in competitive markets. Be patient, as it takes time for new products to gain traction, and focus on delivering a positive customer experience to encourage reviews naturally.

How does Amazon handle fake reviews?

Even the most successful sellers have encountered similar situations, so there’s no need for embarrassment.

Instead, consider this an opportunity to reassess, pinpoint past mistakes, and enhance your future strategies.