How Much Does it Cost to Sell on Amazon in 2024 (Amazon FBA Fees)

Aspiring entrepreneurs often wonder about the expenses of selling on Amazon when they initially explore this platform. After all, when entering the world’s largest e-commerce platform, ensuring profitability is a crucial consideration.

This article takes a look at the fees you’ll pay as an Amazon seller, breaking them out into four distinct sections:

- All Amazon Seller fees

- FBA Seller fees

- FBM Seller fees

- Miscellaneous, optional service fees

FBA Fees All Amazon Sellers Must Pay

Whether an FBA or FBM seller, you must pay these Amazon seller fees to get started.

Referral Fees

A referral fee is the “commission” paid to Amazon for each item sold on their platform. Typically, this fee is a flat percentage, often 15% or less.

However, you don’t have to pay these fees upfront. Instead, referral fees are removed from your Amazon account after the sale.

2024 referral fee update: Starting January 15, 2024, Amazon will reduce referral fees for apparel products priced below $20. For items under $15, they will decrease referral fees from 17% to 5%. For products priced between $15 and $20, they will decrease referral fees from 17% to 10

Individual Per-item Fees or Subscription Fees

There are two types of seller accounts on Amazon: individual and professional.

Depending on the seller account type, you will have to pay either the individual per-item fee Amazon charges you each time you make a sale transaction or you will have to pay a monthly subscription fee.

Individual Seller Per-item Fee

Individual sellers pay a flat $0.99 for each sales transaction instead of a monthly subscription fee.

After a sale is made on Amazon, the referral fees are deducted, and the amount is subtracted from your Amazon account balance.

You do not have to pay the fee upfront.

Professional Seller Subscription Fee

Rather than paying a fee per product sold, professional sellers pay a monthly subscription fee of $39.99. But, like the fees an individual seller pays, subscription fees are taken from your Amazon account balance.

If you don’t have funds in your account, the amount is deducted from your credit card.

Refund Administration Fees

When a customer requests a refund for a product for which they’ve already received payment, Amazon applies a fee to process this refund. This fee amounts to either $5.00 or 20% of the refunded charge, whichever is lower.

Like the other fees discussed, the refund administration fees are promptly deducted from your Amazon account balance. If your account has insufficient balance, the fee is charged to your linked credit card.

Fees that Only FBA Sellers Pay

If you are an FBA seller, these are the fees you’ll pay on Amazon.

FBA Fees

As an FBA seller, you’re not obligated to cover shipping, handling, or packaging expenses for sending your goods. Instead, Amazon’s fulfillment staff handles picking, packing, and shipping your products on your behalf.

You are charged Amazon seller fees to offset these expenses, determined by your product’s size and weight.

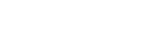

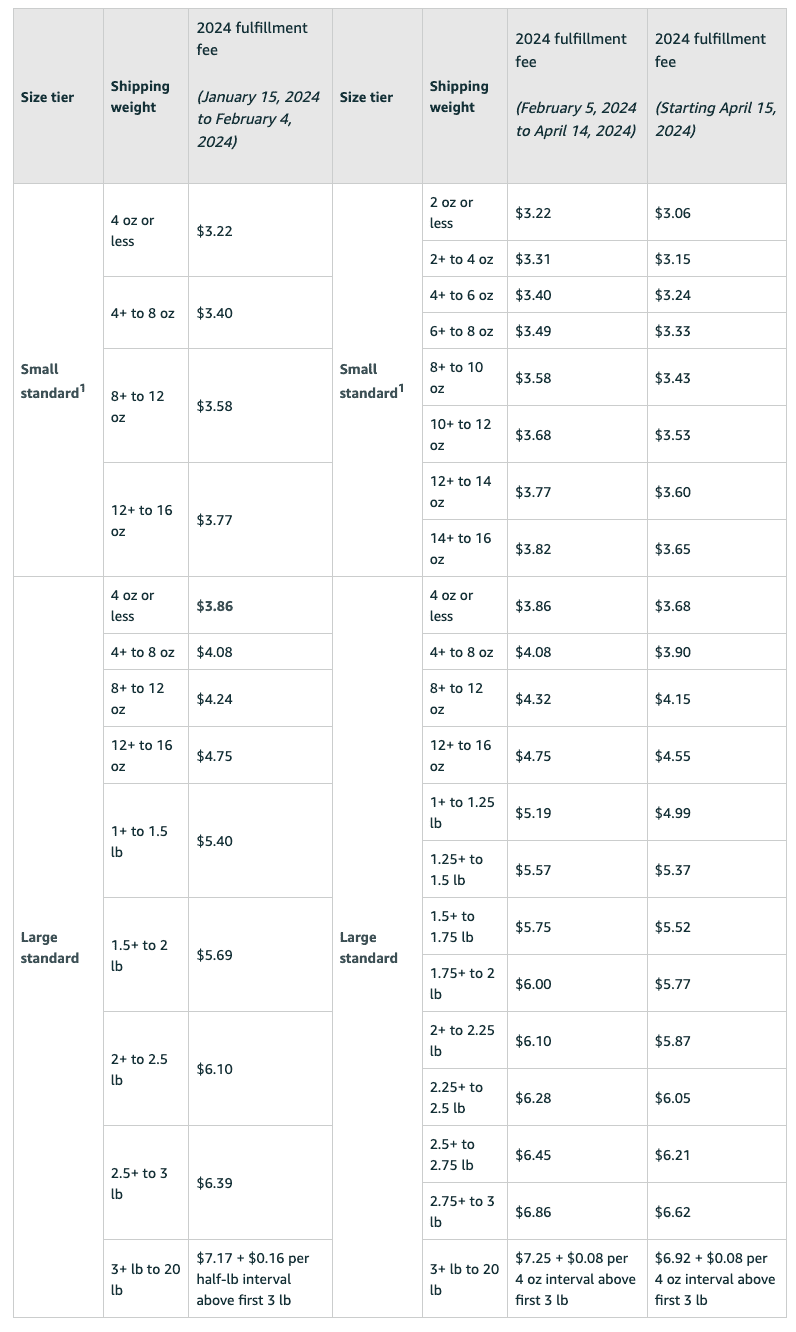

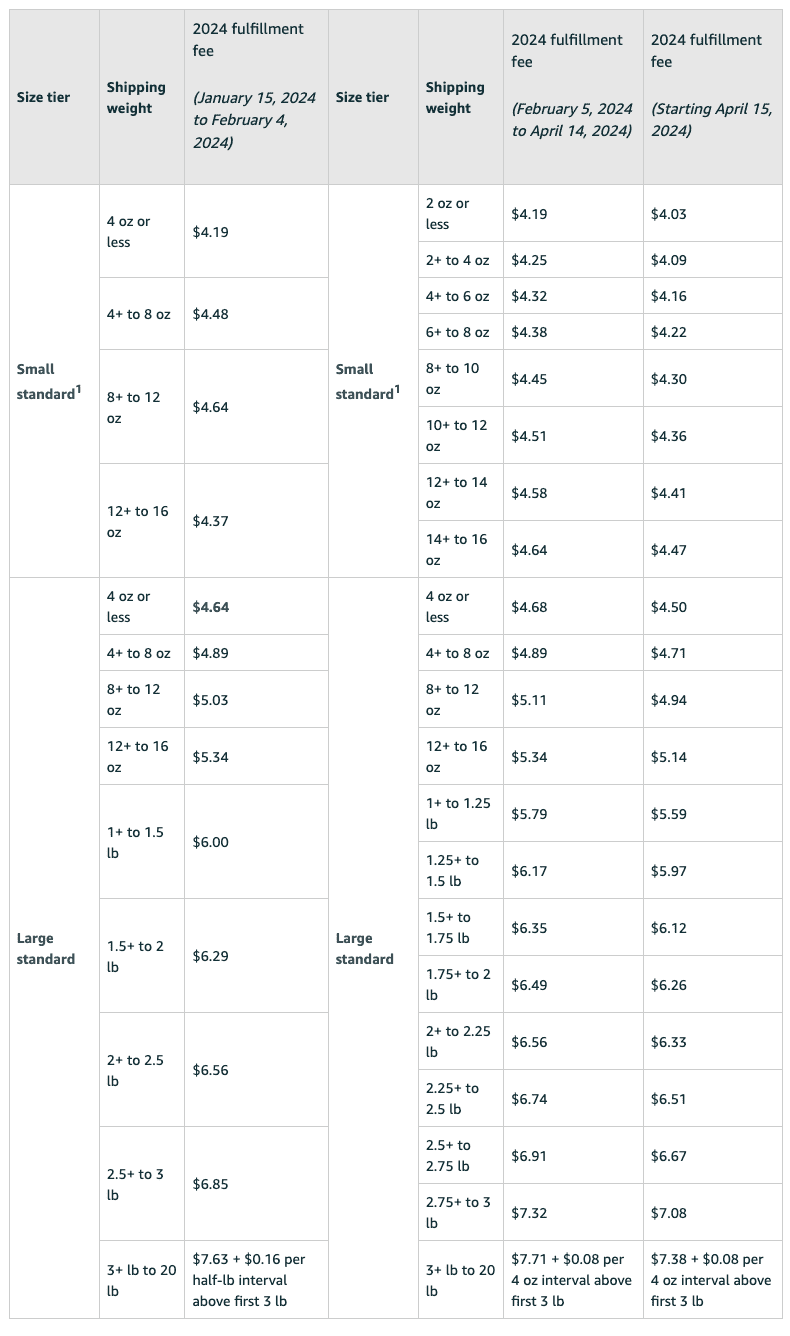

Starting on February 5, 2024, Amazon will introduce more detailed rate cards for standard-sized products and new size tiers for large bulky and extra-large items.

Starting April 15, 2024, FBA fulfillment fees will be reduced for standard-sized and large bulky items. Below is a chart displaying the updated rates and size tiers effective from February 5, 2024, and the new rates applicable from April 15, 2024.

Below are charts showing Amazon’s current FBA fees:

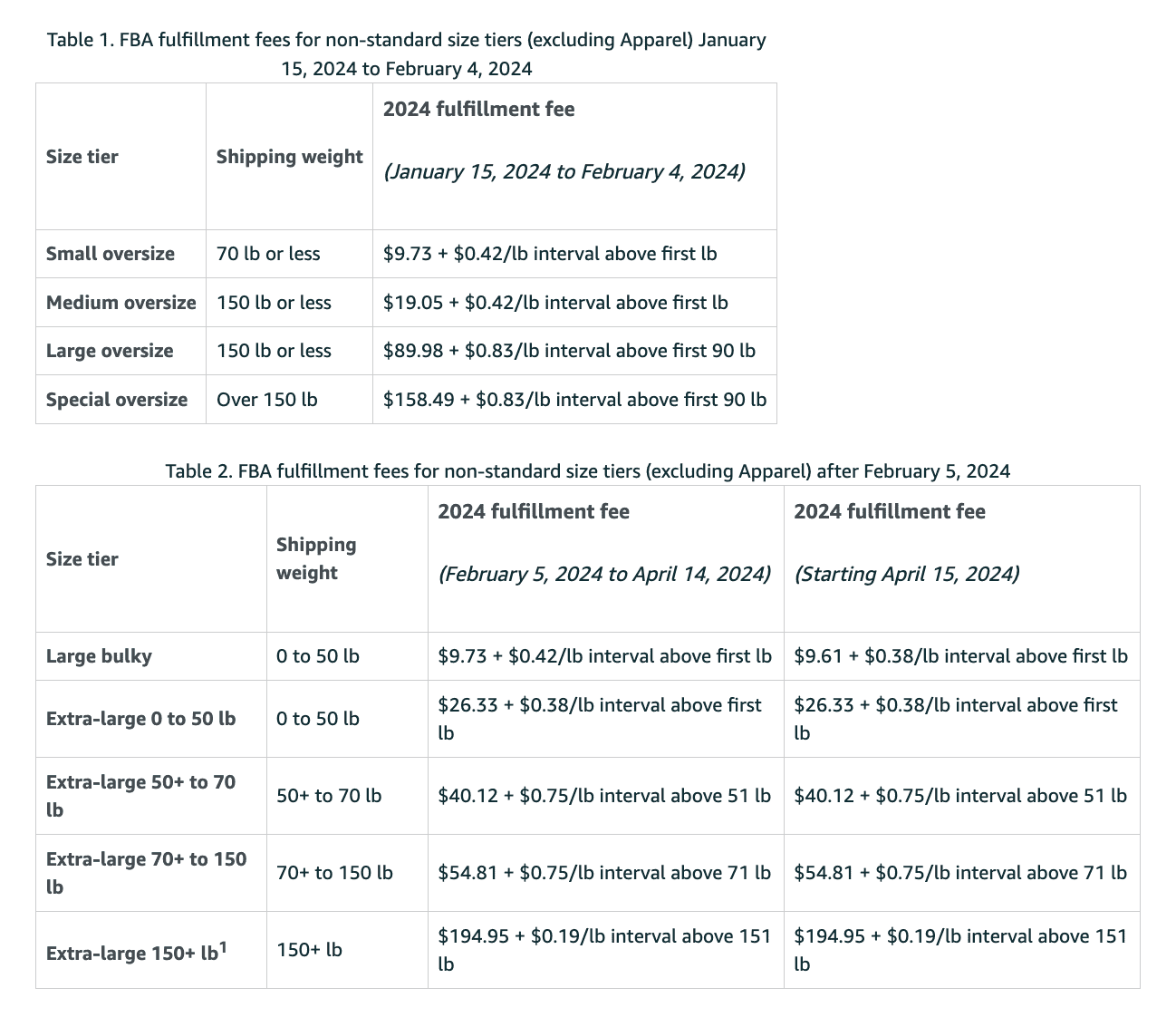

FBA fulfillment fees for Apparel

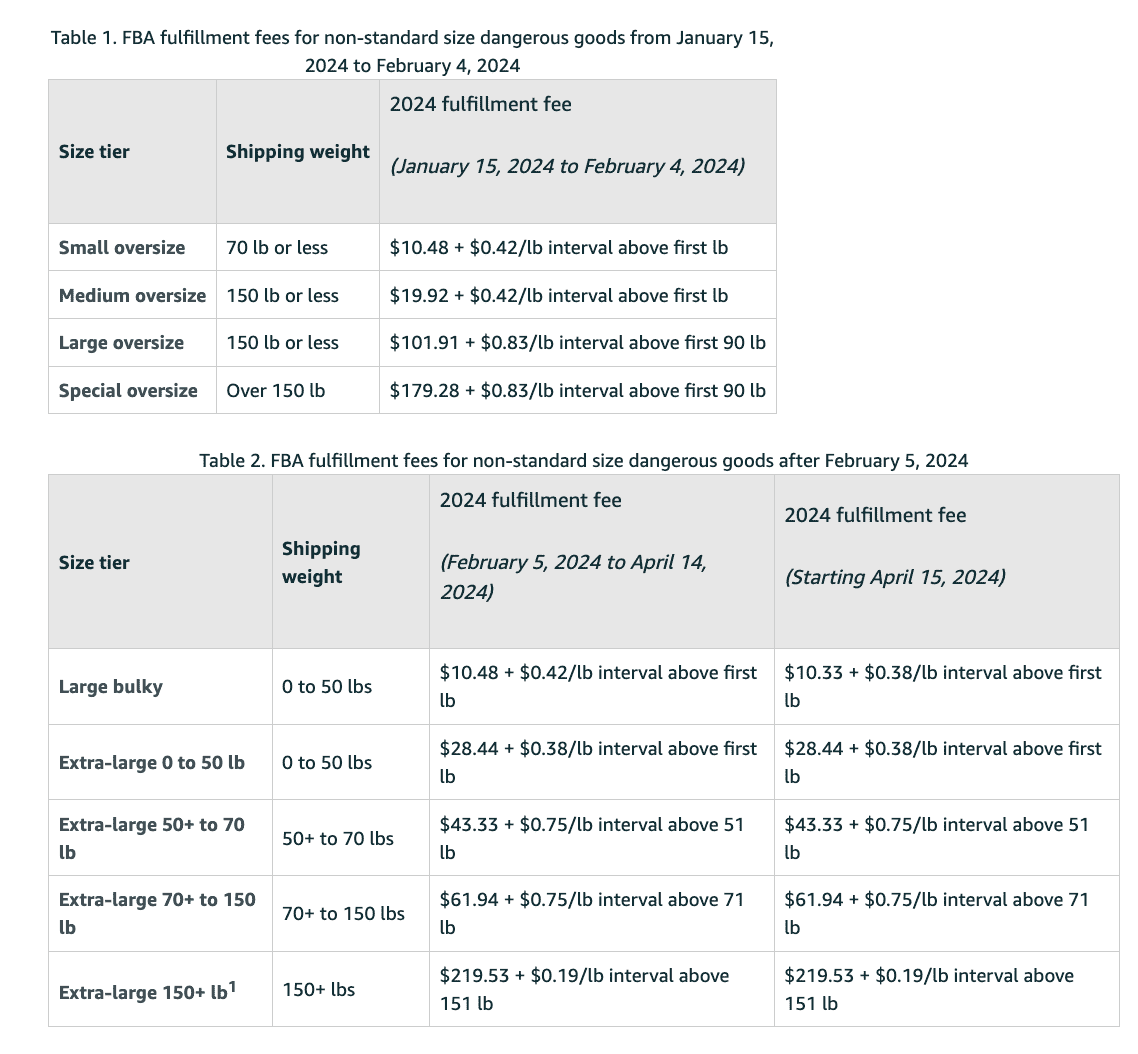

Fulfillment for Dangerous Goods

FBA Storage Fees

Because your products are being stored in Amazon’s fulfillment centers, Amazon charges storage fees to maintain your inventory.

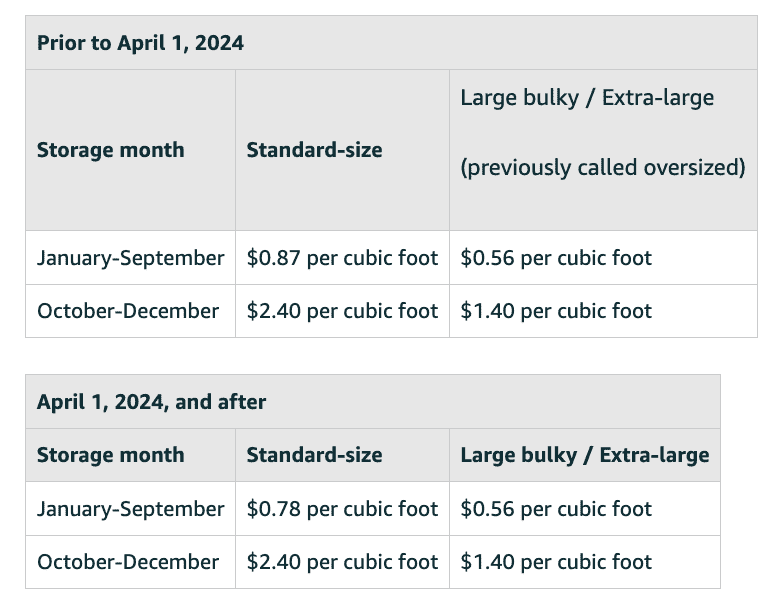

There are two types of FBA storage fees: monthly and long-term.

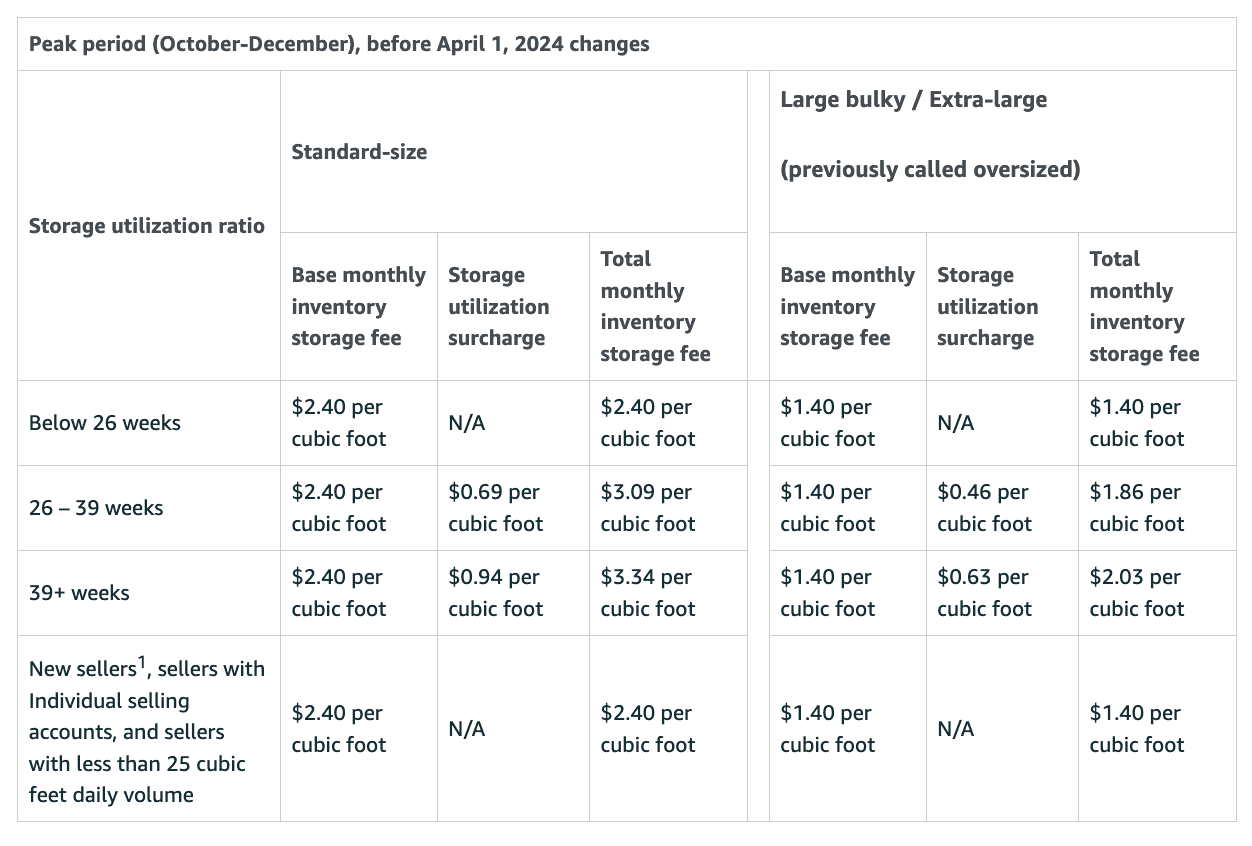

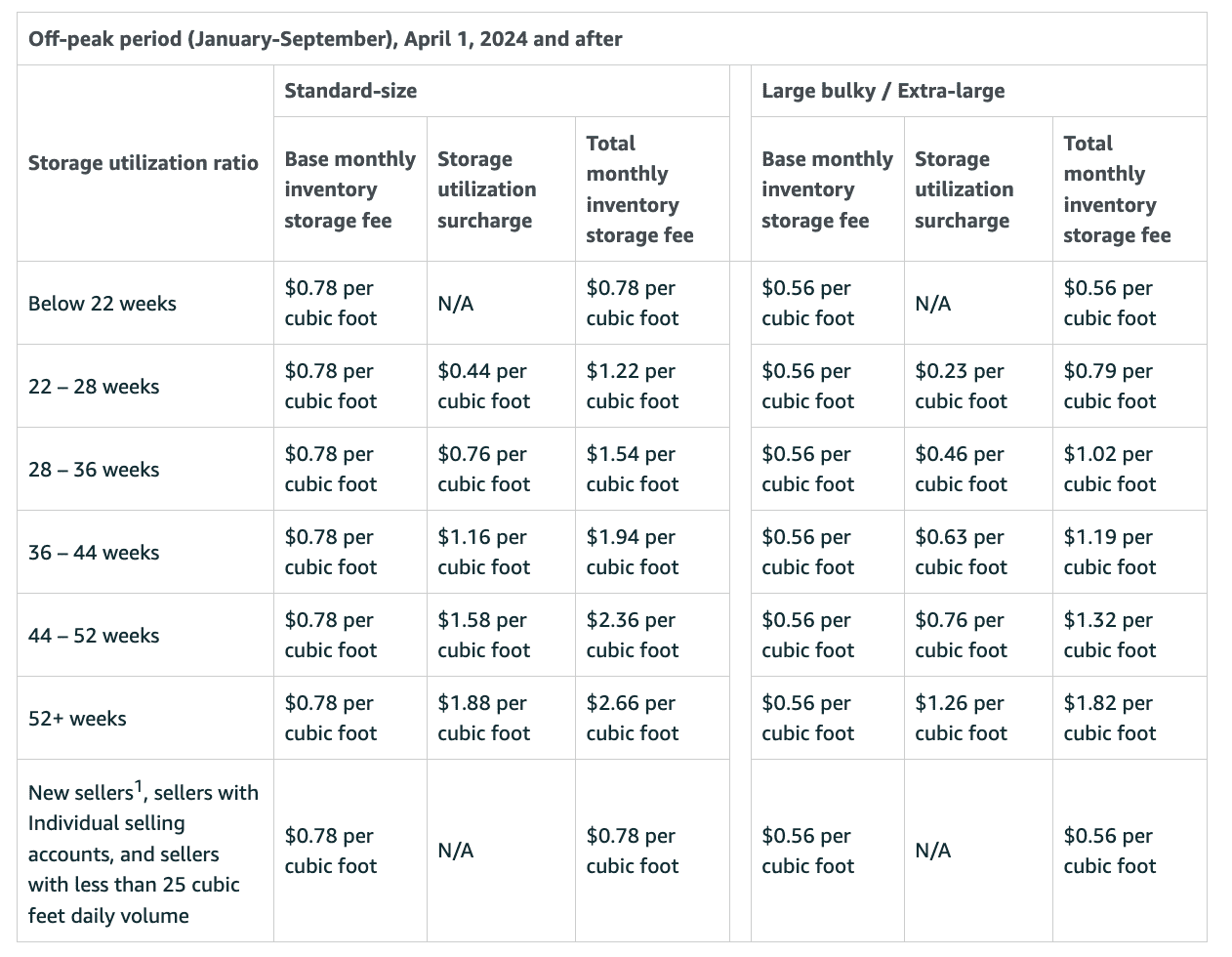

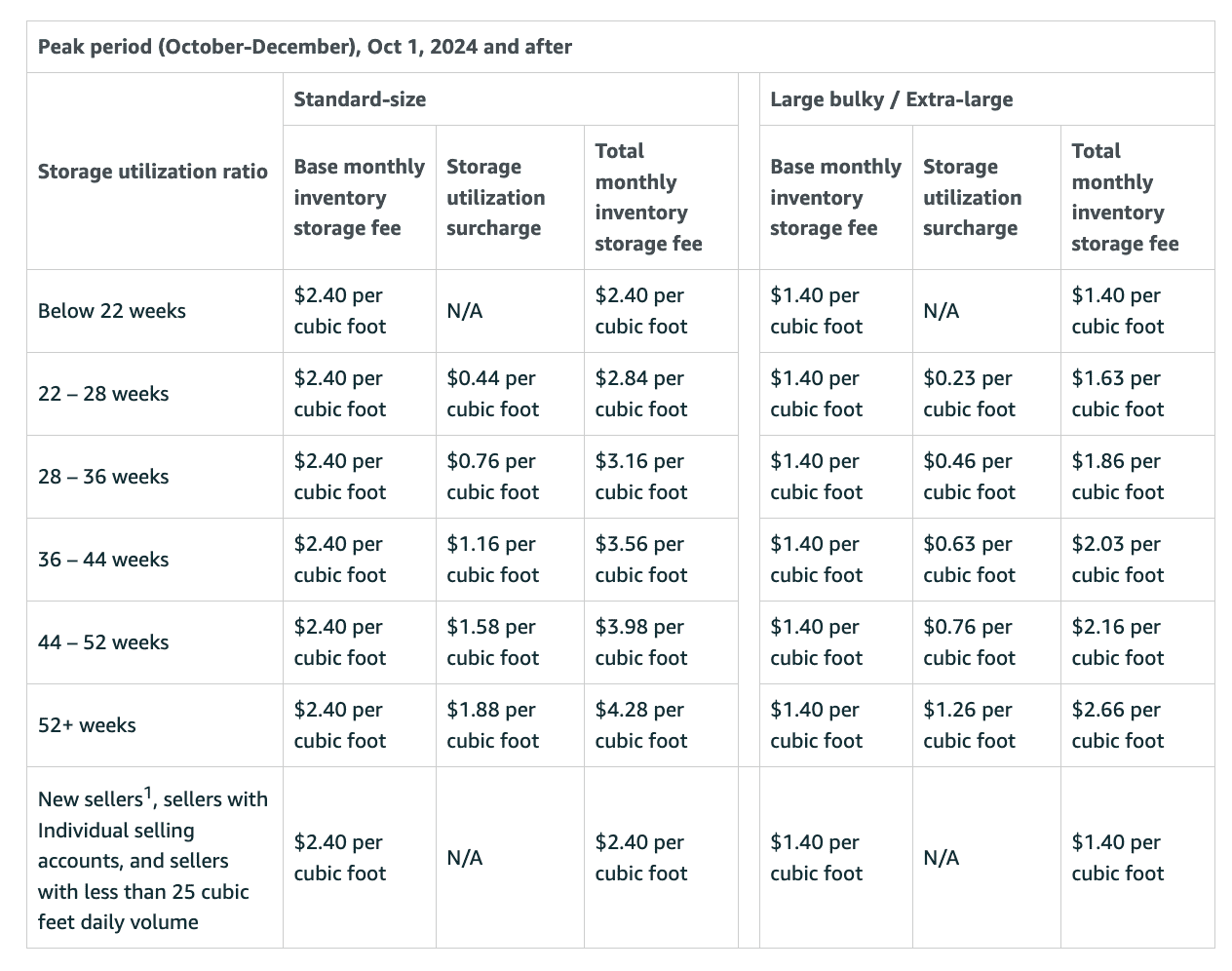

2024 changes: According to Amazon, “Starting April 1, 2024, off-peak monthly inventory storage fees (January-September) will be reduced by $0.09 per cubic foot for standard-size products. This change will first be reflected in May 2024 charges for storage that occur in April 2024. There will be no change to off-peak monthly inventory storage fees for large bulky or extra-large (previously called oversized) products and peak monthly inventory storage fees for standard-size, large bulky, and extra-large products.”

Monthly Storage Fees

After each month, Amazon imposes a storage fee for inventory stored in an Amazon warehouse. These charges are either deducted from your account balance or billed to your linked credit card if your Amazon account lacks sufficient funds to cover the fee.

These are the current monthly storage fees for storing products in Amazon’s fulfillment centers:

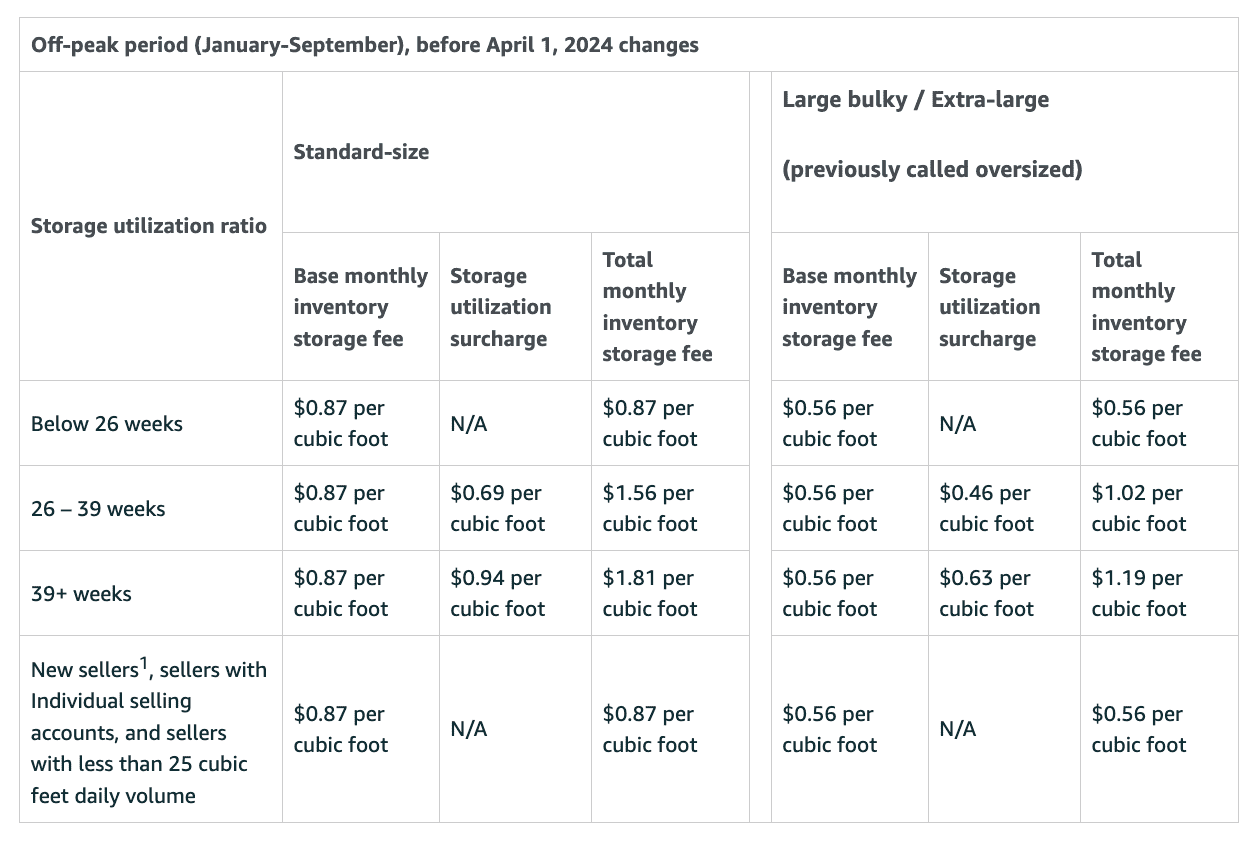

2024 changes to the storage utilization surcharge: According to Amazon, “Starting April 1, 2024, we will introduce more granular fee tiers to the storage utilization surcharge and will start applying the fee to Professional sellers with a storage utilization ratio above 22 weeks. We will exclude inventory aged between 0 and 30 days from the surcharge. This change will first be reflected in May 2024 storage charges that occur in April 2024.”

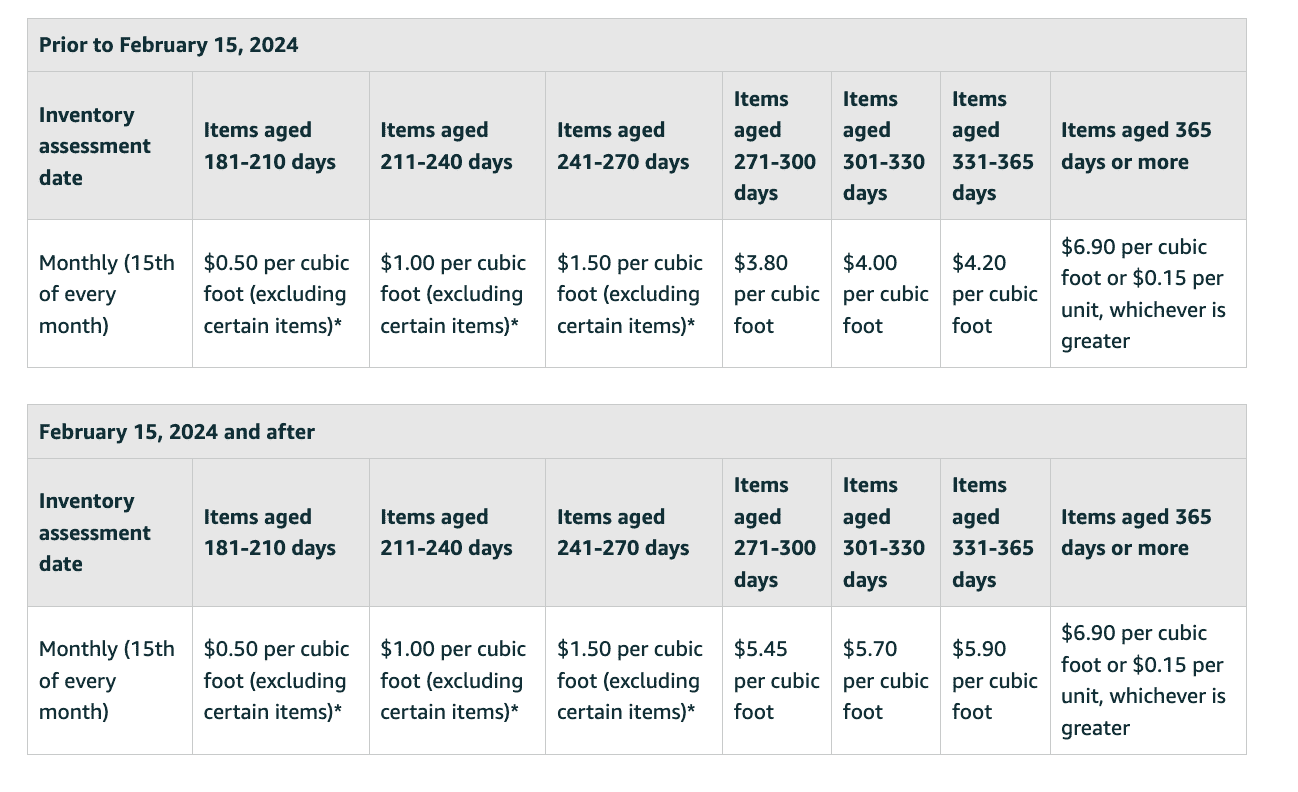

FBA Aged Inventory Surcharge (previously known as long-term storage fees)

From Amazon:

2024 changes to FBA aged inventory surcharge: “Starting February 15, 2024, the aged inventory surcharge for inventory stored between 271 to 365 days will increase. Surcharges will remain unchanged for inventory stored between 181 to 270 days and 365 days or more.”

Amazon performs inventory clean-ups on the 15th of every month, identifying products stored in their fulfillment centers for 181 days or more.

For items stored beyond 181 days, Amazon imposes an aged inventory surcharge, based on the duration of storage.

Like the monthly storage fees, the aged inventory surcharge is deducted from your Amazon seller account balance on the 15th of each month or charged to the credit card registered in your Amazon seller profile.

Note: During Amazon’s busy seasons, these fees will go up to persuade sellers to remove slow-selling inventory.

Low-level Inventory Fee

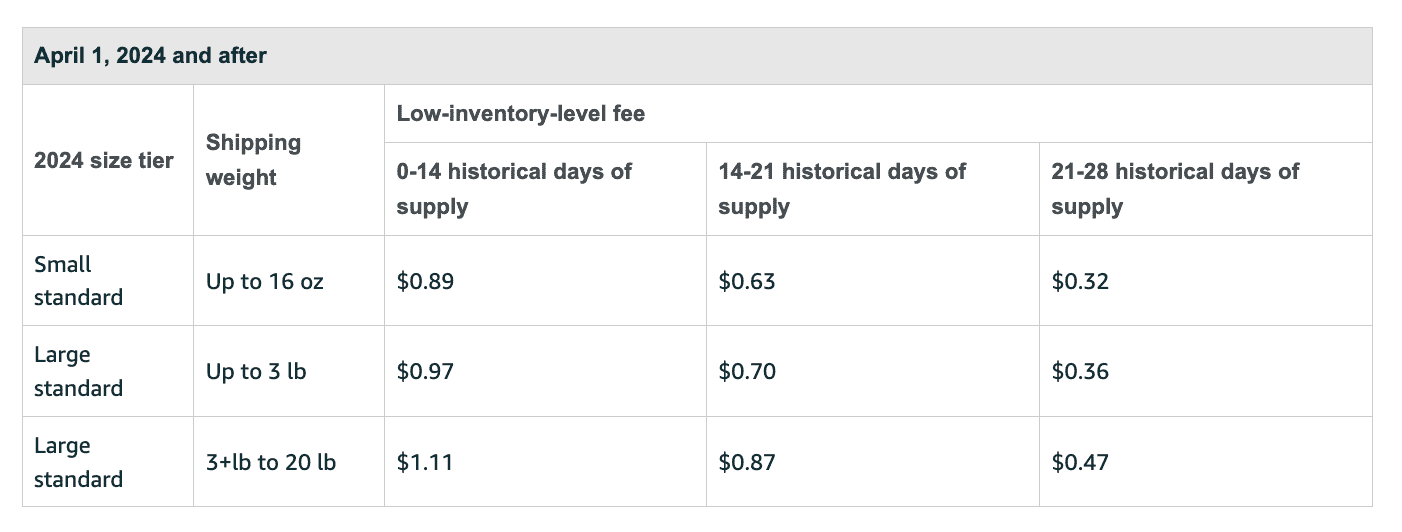

Effective April 1, 2024, Amazon will introduce a new low-level inventory fee that will apply to standard-sized products with consistently low inventory relative to customer demand.

According to Amazon, “When sellers carry low inventory relative to unit sales, it inhibits our ability to distribute products across our network, degrading delivery speed and increasing shipping costs.

The low-inventory-level fee will only apply if a product’s inventory levels relative to historical demand (historical days of supply) are below 28 days. We will only charge the low-inventory-level fee when both the long-term historical days of supply (last 90 days) and short-term historical days of supply (last 30 days) are below 28 days (4 weeks). For example, if a product’s short-term historical days of supply are above 28 days but its long-term historical days of supply are below 28 days, the low-inventory-level fee won’t apply.

We will calculate the historical days of supply metric at the parent-product level and will add the low-inventory-level fee to the FBA fulfillment fee for all shipped units of eligible products. Below is the low-inventory-level fee rate card.”

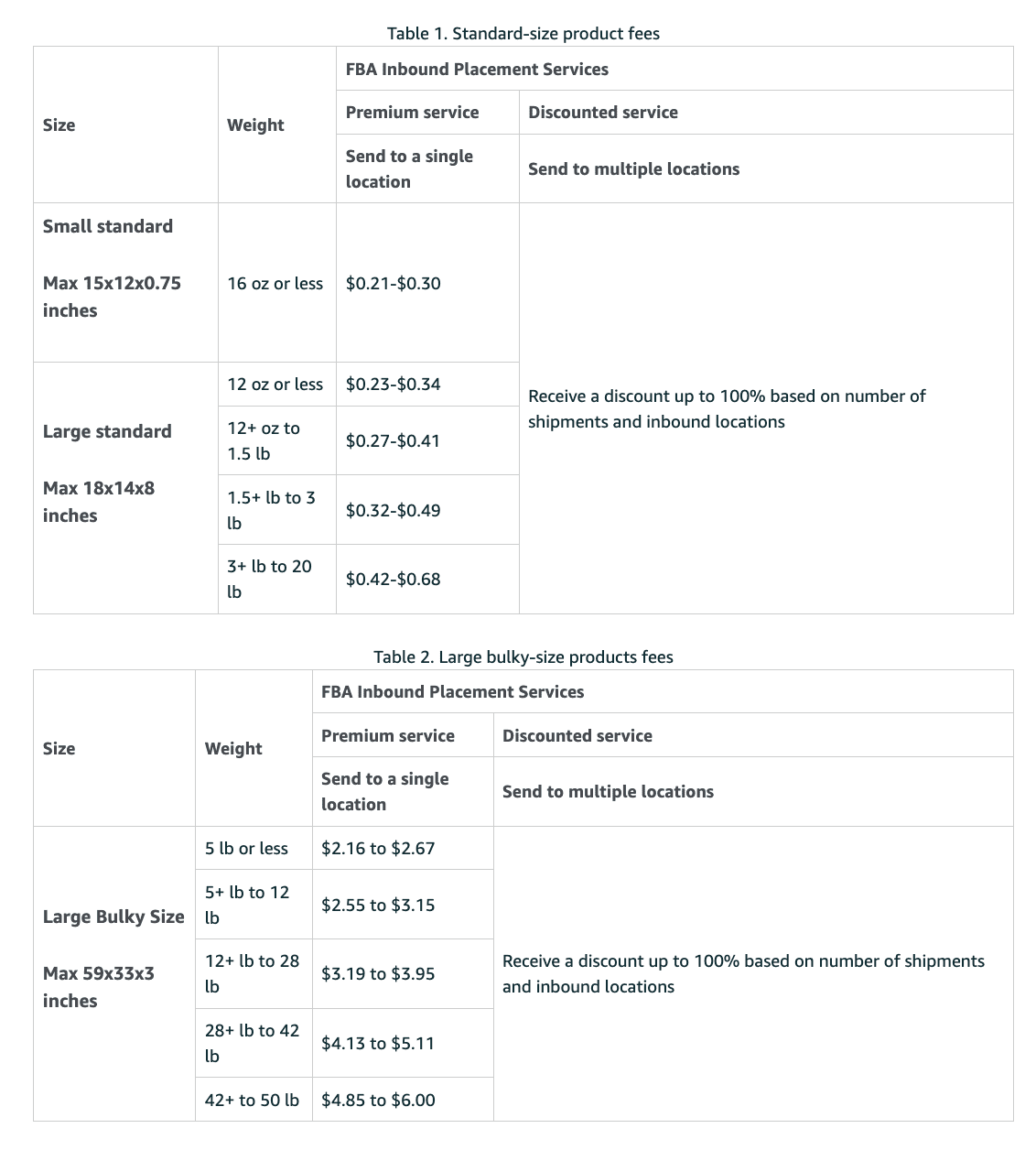

FBA Inbound Placement Service Fee

Effective March 1, 2024, Amazon will implement an FBA inbound placement service fee for standard and large bulky-sized products to reflect the cost of distributing inventory to fulfillment centers close to customers.

Fees That Only FBM Sellers Pay

FBM sellers on Amazon don’t have distinct fees as FBA sellers do. However, the overall cost of selling on Amazon as an FBM seller often surpasses that of an FBA seller. This is because FBM sellers are responsible for storing, selecting, packaging, and shipping their products and managing their customer service.

For instance, if I were an FBA seller selling a stainless steel mug for $30, I’d incur $4.50 in referral fees and $5.06 in FBA fees.

In contrast, as an FBM seller vending the same product, I’d need to consider additional expenses such as shipping costs (estimated at $6) and packaging costs (estimated at $1), totaling fulfillment expenses to approximately $7 (before any labor or storage expenses).

Miscellaneous Service Fees

The last group of fees mentioned in this article are fees that only a few sellers must pay. These fees are paid regardless of whether you are an Amazon FBA or FBM seller.

Closing Fees

Media products, such as books, DVDs, CDs, and Blu-Ray, come with a flat $1.80 fee per sale, and only sellers who focus on selling these products need to worry about these fees.

Like the referral fee, the closing fees are deducted from the sale proceeds, so you do not need to pay these fees in advance.

High-volume Listing Fee

Sellers with thousands of ASINs may be required to pay a monthly flat fee of $0.005 per eligible ASIN. But unless you have more than 100,000 products listed, you won’t have to worry about these fees.

High-volume listing fees are paid at the same time as FBA storage fees. These fees are deducted from your Amazon account balance. The amount is deducted from your credit card if you don’t have funds in your account balance.

Is There a Way to Estimate or Predict the total FBA Fees for a Product Before Listing it on Amazon?

Before listing a product on Amazon using Fulfillment by Amazon (FBA), you can estimate the total fees involved to ensure profitability. This estimation comprises several factors, including fulfillment fees, referral fees, storage fees, and any additional services, like labeling or prep services.

Fulfillment fees are influenced by the product’s size, weight, and shipping method and can be calculated using Amazon’s fee calculator tool on Seller Central. Referral fees are a percentage of the total sales price, varying by product category. Storage fees may apply if the product remains in Amazon’s fulfillment centers long.

By considering these factors and utilizing Amazon’s resources, you can predict the total FBA fees and adjust your selling price accordingly to maintain profitability.

Can You Explain the Difference Between Amazon Referral Fees and FBA Fees for Sellers?

The difference between Amazon referral fees and FBA fees for sellers boils down to what each fee covers and how it’s calculated. Referral fees are charges imposed by Amazon for selling products on its platform. They are calculated as a percentage of the total sale price, irrespective of whether fulfillment is done through Amazon’s services or by the sellers themselves.

On the other hand, FBA fees are tied explicitly to the fulfillment services provided by Amazon, covering tasks like picking, packing, shipping, and customer service for orders. These fees are influenced by the product’s size, weight, and shipping method. While referral fees are universal for all sellers, FBA fees are incurred only by those who utilize Amazon’s fulfillment services.

Both types of fees are crucial for sellers in determining pricing and overall profitability on the platform.

Are there Additional Costs Associated with Amazon FBA Beyond the Standard Fulfillment and Storage Fees?

Sellers may encounter several additional costs beyond the standard fulfillment and storage fees associated with Amazon FBA. Long-term storage fees apply to inventory stored for over 365 days, while removal or disposal fees are incurred when removing or disposing of stored items.

Return processing fees cover the costs of handling returned items, and sellers may opt to pay for the Inventory Placement Service to consolidate inventory in one fulfillment center. Additionally, there are fees for Amazon’s FBA label service if sellers choose not to label products themselves.

These additional costs should be considered when pricing products and managing inventory to ensure profitability when utilizing Amazon FBA.

Book your Free Consultation with us, or get in touch here: james@realdigital.tw