What is LLC in Amazon?

Introduction

As more entrepreneurs look to capitalize on the booming e-commerce market, a common question arises: Is establishing an LLC required to sell on Amazon in 2024? With the platform’s expansive reach and diverse selling opportunities, understanding the legal and business structures that best support your venture is crucial. In this guide, we’ll explore whether forming an LLC offers significant advantages or if you can successfully navigate Amazon’s marketplace with other business structures.

What is an LLC?

A Limited Liability Company (LLC) is a business entity in the U.S. that protects its owners against personal liability for business debts and legal claims. Unlike a sole proprietorship, an LLC creates a legal distinction between the owner(s) and the business itself, ensuring that the owners are not personally responsible for the company’s financial obligations or legal issues—the LLC assumes that responsibility. Additionally, while a single individual owns a sole proprietorship, an LLC can have multiple members.

What is Sole Proprietorship?

A sole proprietorship is a business structure where one individual owns and operates the business without formal incorporation. To establish a sole proprietorship, you just need to begin offering products or services; you become a sole proprietor as soon as you start selling. This structure is the easiest way to conduct business online, but it’s essential to understand that it does not provide a legal distinction between the owner and the business. Consequently, the owner is liable for any financial obligations or legal issues.

What sets an LLC apart from a sole proprietorship?

The primary distinction lies in the level of protection each offers. An LLC (Limited Liability Company) is a distinct legal entity from its owners. It can operate independently—open bank accounts, incur debts, borrow money, sue and be sued, and even buy or sell property. This separation provides significant protection: if the LLC faces legal issues or financial problems, only the LLC’s assets are at risk, not the owner’s assets.

In contrast, a sole proprietorship does not provide this separation. As a sole proprietor, you are personally liable for any business-related debts or legal claims, which means your assets, such as your home or savings, could be at risk.

Deciding between an LLC and a sole proprietorship might seem complex, but the concepts become clear with some research. While business insurance can offer some protection, an LLC inherently shields your assets from business liabilities. Even if a single-person LLC is taxed similarly to a sole proprietorship, it provides more excellent legal protection. Therefore, while starting as a sole proprietorship is straightforward, considering an LLC can be crucial for safeguarding yourself and your business in the long run.

LLC Advantages and Disadvantages

When running a business on Amazon, forming an LLC has its own set of advantages and disadvantages:

Advantages:

- Liability Protection: An LLC protects your assets from business liabilities, crucial in disputes, returns, or financial issues related to your Amazon business.

- Tax Flexibility: LLCs offer flexible tax options. You can be taxed as a sole proprietor, partnership, or corporation, which can help you optimize your tax strategy based on your business’s profitability and structure.

- Credibility: Operating as an LLC can enhance your business’s credibility and professionalism on Amazon, potentially leading to better customer trust and higher conversion rates.

- Ease of Management: LLCs have fewer formalities and administrative requirements than corporations. This can simplify your business operations and allow you to focus more on managing your Amazon store.

- Profit Distribution Flexibility: LLCs allow for flexible profit distribution among members, which can be advantageous for business owners looking to manage earnings in a way that suits their financial goals.

Disadvantages:

- Formation and Maintenance Costs: Setting up and maintaining an LLC can involve costs such as filing and annual state fees, which might concern small or new Amazon businesses.

- Complexity in Tax Filing: Depending on how you choose to be taxed, LLCs might have more complex tax filing requirements than sole proprietorships, potentially requiring the help of a tax professional.

- Limited Investment Appeal: LLCs may be less attractive to investors compared to corporations, which might limit your options for raising capital if you plan to expand your Amazon business significantly.

- State-Specific Regulations: LLC regulations and fees vary by state, which can add complexity if you operate across multiple states or plan to expand your business.

- Self-Employment Taxes: In some cases, LLC members may be subject to self-employment taxes on their share of the business income, which can be higher than corporate tax rates.

When is the ideal time to establish an LLC for your Amazon business?

Consider forming an LLC when you’re ready to commit seriously to growing your e-commerce venture. An LLC offers valuable protection for both you and your business. It’s wise to set up an LLC if:

- You are dedicated to expanding your Amazon business

- Your monthly sales are consistently increasing

- You sell products that carry potential risks, such as sports equipment, health and wellness items, or supplements

- You want to separate yourself from your business legally

- You have one or more business partners

If any of these situations apply to you, setting up an LLC should be a priority. The process is generally straightforward, and the long-term benefits of legal protection can be significant.

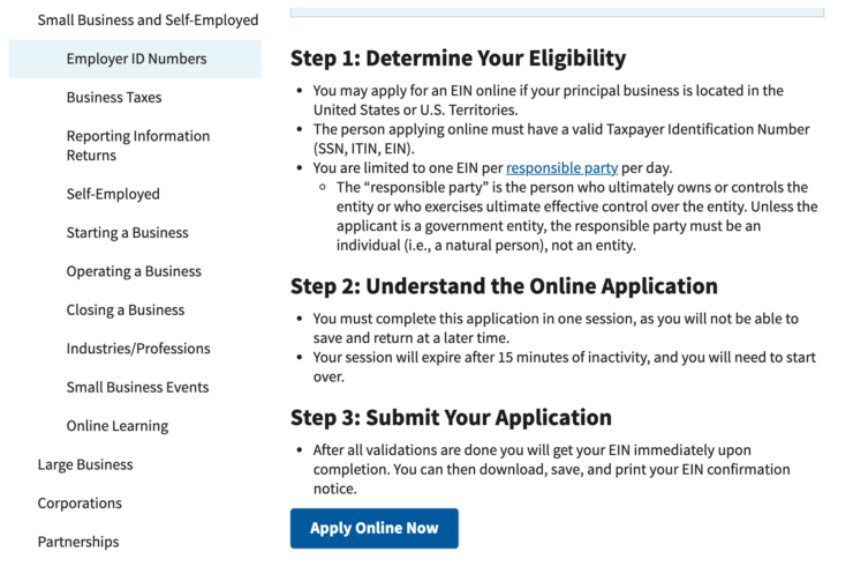

What is EIN?

An Amazon EIN, or Employer Identification Number, functions like a social security number for your business. Also referred to as a Federal Tax Identification Number, it enables the IRS to monitor your business activities for tax-related purposes. You will need an EIN when you form an LLC. This number functions like a social security number for your business and is used by the IRS to identify your company. You can apply for an EIN for free on the IRS website. Be cautious of websites or services that charge fees for obtaining an EIN, as the application process is simple and cost-free.

Is LLC necessary for Amazon wholesale in the USA?

An LLC is not required to sell wholesale on Amazon in the USA, but it is highly recommended. It protects personal liability, enhances business credibility, offers tax advantages, and establishes a formal business structure. While not mandatory, forming an LLC can be beneficial for managing risks and scaling your wholesale operations effectively.

Which state LLC is best for Amazon?

The best state for forming an LLC for your Amazon business depends on factors like tax implications and legal requirements. Delaware is famous for its business-friendly laws and solid legal protections. Nevada offers no state income tax and privacy protections, and Wyoming is known for low fees and strong privacy. However, forming an LLC in your home state might simplify tax and legal matters if you conduct significant business there. Consulting a legal or financial advisor can help determine the best choice based on your specific needs.

What's the difference between Amazon and Amazon LLC?

“Amazon” refers to the e-commerce platform and parent company, Amazon.com, Inc., which facilitates buying and selling goods. In contrast, “Amazon LLC” would be a specific business entity—an LLC (Limited Liability Company)—operating as a seller on Amazon’s platform. The former is the overarching company running the marketplace, while the latter is a legal business structure individuals or companies use to sell products on Amazon.

Book your Free Consultation with us, or get in touch here: james@realdigital.tw